Credit card 100

Now is a good time to order a card, because new customers will get 3% back on all February purchases! Credit Card 100 is a fee-free credit card with no interest or additional charges - you repay exactly the amount you spend. The monthly limit for the card is €100. See the more detailed terms and conditions below.

Interest rate

ATM

Contrac and maintenance fees

Card limit

Free of charge

Also available in

With the Credit Card 100, you can make payments in retail stores and online shops. You can also add it as a payment card for subscription services, whether it’s food delivery, streaming services, ride-sharing, and more. It is also possible to withdraw money from ATMs with a Holm credit card.

Like all Holm credit cards, purchases made with the Credit Card 100 are protected by purchase insurance. Read more here.

Campaign for new clients

Offer valid for new customers

On February purchases

Holm will transfer the cashback

Your virtual card is ready to use

Campaign for card clients

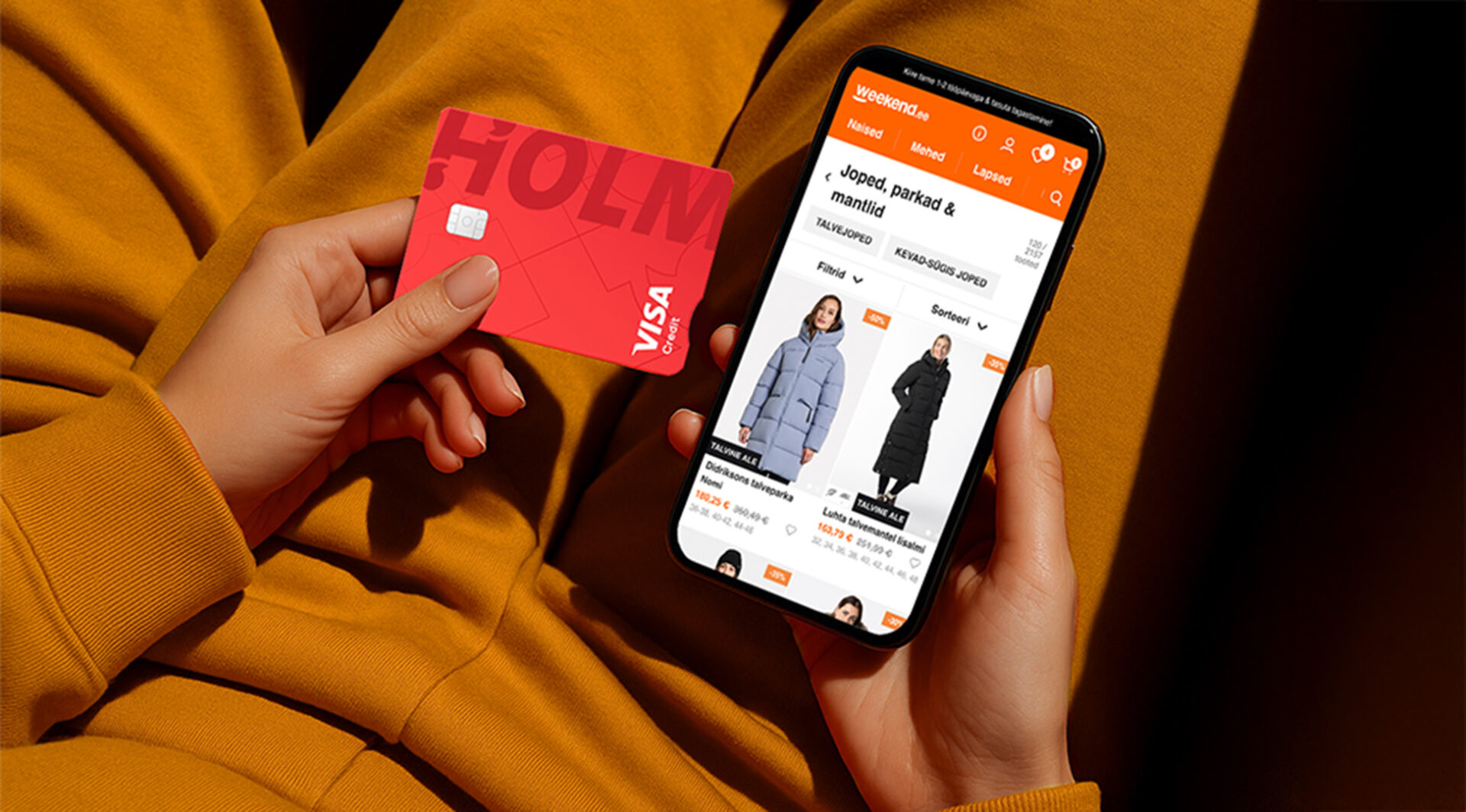

Get 10% cashback with your Holm card in Weekend shops and online-store from January to March!

Pay for your purchases made between January and March in Weekend shops and online store with your Holm credit card or Credit card 100.

Holm Bank will transfer 10% of the purchase amount made from January to March back to your Holm customer account during the following month.

Credit card with higher limit

Are you interested in a higher limit? Check out the Holm credit card, which has a limit of up to €5,000, a monthly interest rate starting from 1.2%, and the first 15 days after purchase are always interest-free.

Monthly and maintenance fees

Contractual fee

Frequently asked questions

the compulsory repayable instalment that is always equal to your used credit limit, the available limit according to the agreement, and the statement of transactions.

The invoice must be paid no later than the 10th day of the month. Repayments are to be made to the current account of Holm Bank AS EE391010220035757017 in SEB Bank or EE087700771000802113 in LHV Bank.

The reference number is mandatory! In case of arrears, the use of the card will be suspended

The financial services provider is Holm Bank AS. The issuer of the card is Wallester AS. Carefully consider your decision and review the terms and conditions of the contract before making your decision. If you have any questions or need advice, contact us.