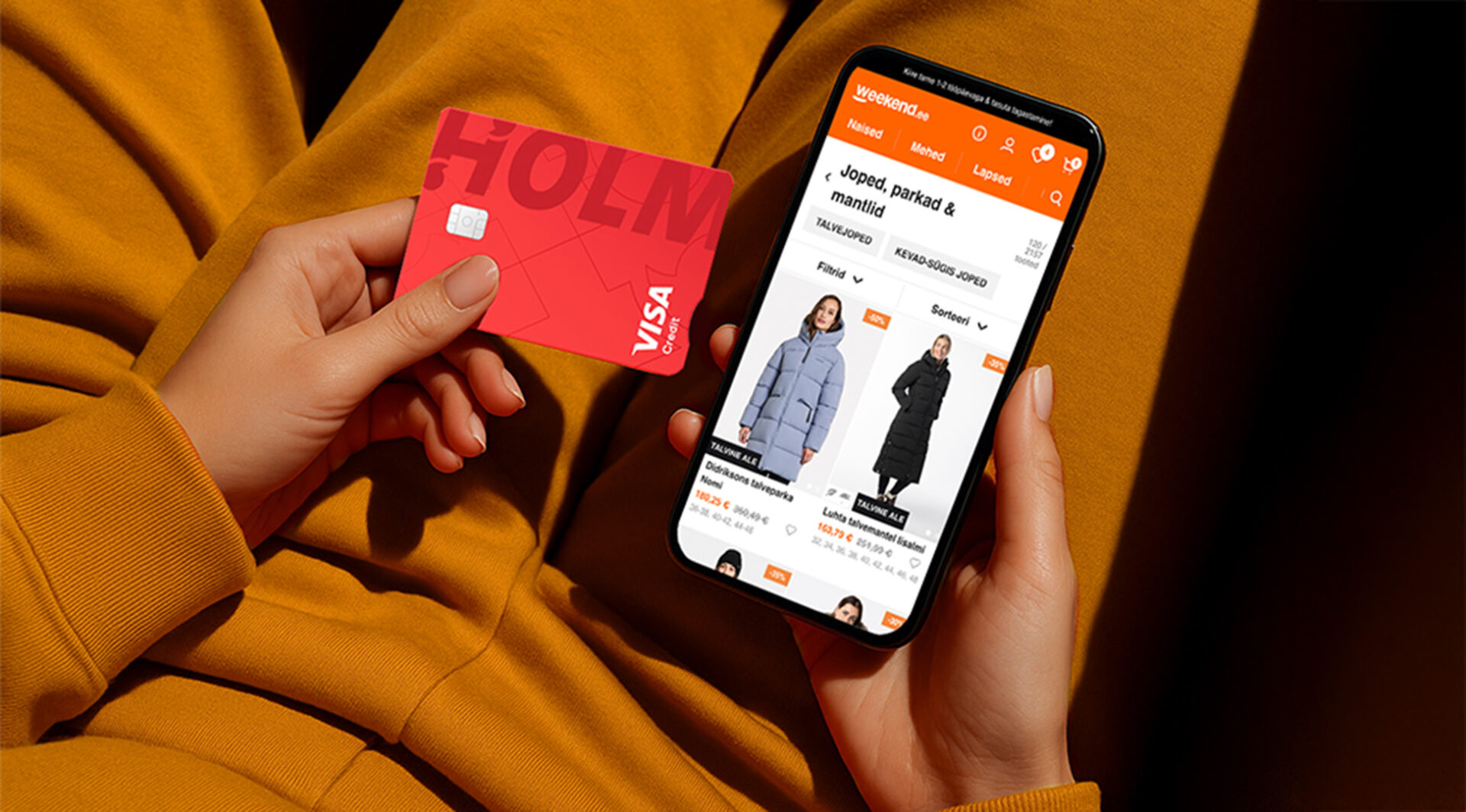

Credit card

Now is a good time to order a card, because new customers will get 3% back on all February purchases!

Credit card users will also get 10% back on the purchase amount when paying with the Holm card in Weekend stores and the online shop until the end of March.

See the more detailed terms and conditions below.

Offer for first-time customers

Monthly interest rate

15 days

Contract and maintenance fees

Free of charge

Also available in

Holm offers a physical and virtual VISA credit card without monthly fees, which you can apply for via Holm self-service and app. We will send the plastic card to your home address within a week, free of charge, and the virtual card will be ready to use as soon as you sign the contract. The app and self-service offer a convenient overview of your payments and other transactions.

You can use the card in retail shops, online stores and to pay for services. It is also possible to withdraw money from ATMs with a Holm credit card. Purchases made with the Credit Card are protected by purchase insurance. Read more here.

To find out your personal credit limit, please fill out the application in our self-service.

Campaign for new clients

Offer valid for new customers

On February purchases

Holm will transfer the cashback

Your virtual card is ready to use

Offer in Weekend shops and online store

Get 10% cashback with your Holm card in Weekend shops and online-store from January to March!

Pay for your purchases made between January and March in Weekend shops and online store with your Holm credit card or Credit card 100.

Holm Bank will transfer 10% of the purchase amount made from January to March back to your Holm customer account during the following month.

Frequently asked questions

The physical credit card should be activated in the app or on our self-service site, virtual credit card is ready to be used right away after you have activated internet purchases and inserted 3D Secure password.

The financial services provider is Holm Bank AS. The issuer of the card is Wallester AS. Read the terms of the contract and consult an expert. The annual percentage rate is 36.89% under the following sample conditions: credit limit €2,000, fixed interest rate 30.00% per annum, total repayments €2,605.19. This rate is calculated on the assumption that the credit limit is immediately used in full and repaid in equal monthly instalments over a period of one year with the total amount repaid being €2,605.19.